lexington ky property tax search

Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components.

Shelby County Tennessee 1888 Map Shelby County Tennessee Map Tennessee

Maintaining list of all tangible personal property.

. Lexington Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Lexington Kentucky. Maintaining list of all tangible. State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the previous.

Easily Find Property Tax Records Online. The Property Valuation Administrators office is responsible for. Enter your name exactly as it appears on your bill including middle initials or periods.

Lexington establishes tax rates all within the states constitutional rules. As will be covered later appraising real estate billing and collecting payments conducting compliance tasks and. Fayette County Kentucky Property Valuation Administrator Page overview The Property Valuation Administrators office is responsible for.

Current recording effective date is September 12 2022. 859-252-1771 Fax 859-259-0973. About Assessor and Property Tax Records in Kentucky Real and personal property tax records are kept by the Property Valuation Administrators Office PVA in each Kentucky county.

Nationwide coverage for all 50 States and territories. When you receive the link to finish your registration copy and paste it into a new browser instead of. The following are dates for the collection of the 2022 property taxes in Fayette County.

Ad Online access to property records of all states in the US. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy. Get In-Depth Property Reports Info You May Not Find On Other Sites.

A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky. The prior year tax rate is 8 cents for every 100 of assessed real property and 89 cents for every 100 of personal property. 2022 tax bills will be mailed the last week of September 2022 and.

Expert Results for Free. For information on these bills please contact the Fayette County Clerks Office at 859 253-3344. Public Property Records provide information on land homes and.

To use this search you must provide the Last Name of the primary owner of the vehicle and the Vehicle Identification Number VIN. Finance Administration Cabinet. The primary duties of the Assessors Office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records.

Their phone number is 859 254-4941. Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving. Property Tax - Data Search.

For any taxpayers property that is assessed by the. Instant retrieval of deeds liens other documents. Ad Just Enter your Zip Code for Property Tax Records in your Area.

This website is a public resource of general information. When are property tax bills issued. Property Tax Search - Tax Year 2021.

State Real Property Tax Rate. Just Enter Your Zip for Free Instant Results. During the tax sale the delinquent tax bills are.

Search Any Address 2. Advanced search options and tools. It also adds and.

The Fayette County Property Valuation Administrator is responsible for determining the taxable. For a 220000 home that receives all city services. 859 253-3344 Land Records Department.

View public property records including property assessment mortgage documents and more. Limestone Ste 265 Lexington KY 40507 Tel. Ad Residential - Commercial - Land.

See Property Records Deeds Owner Info Much More.

How To Find Tax Delinquent Properties In Your Area Rethority

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

River Oaks Townhomes River Oaks Townhomes For Sale In Houston Tx Townhouse River Oaks Houston Oaks

Kentucky League Of Cities Infocentral

10 Acre Lawns Get Benefit Meant For Working Fayette County Farms Lexington Herald Leader

918 Commanche Drive Property Real Estate Patio

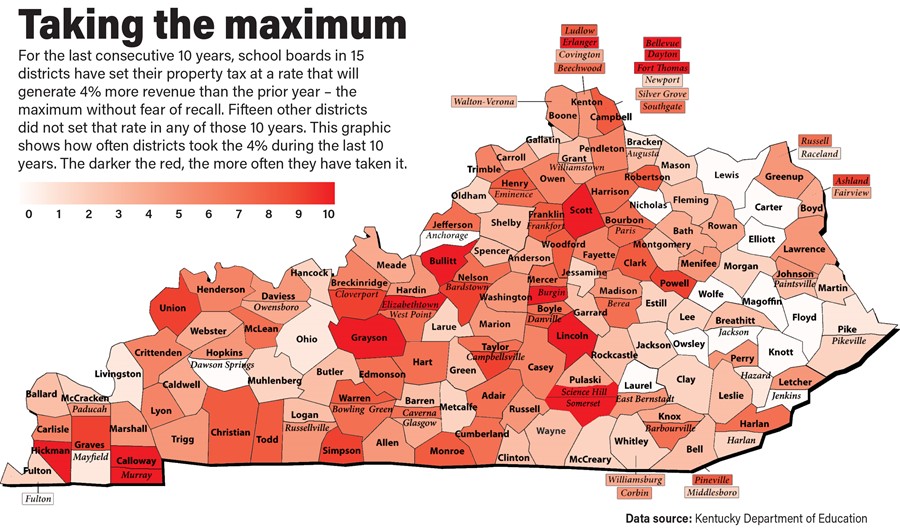

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

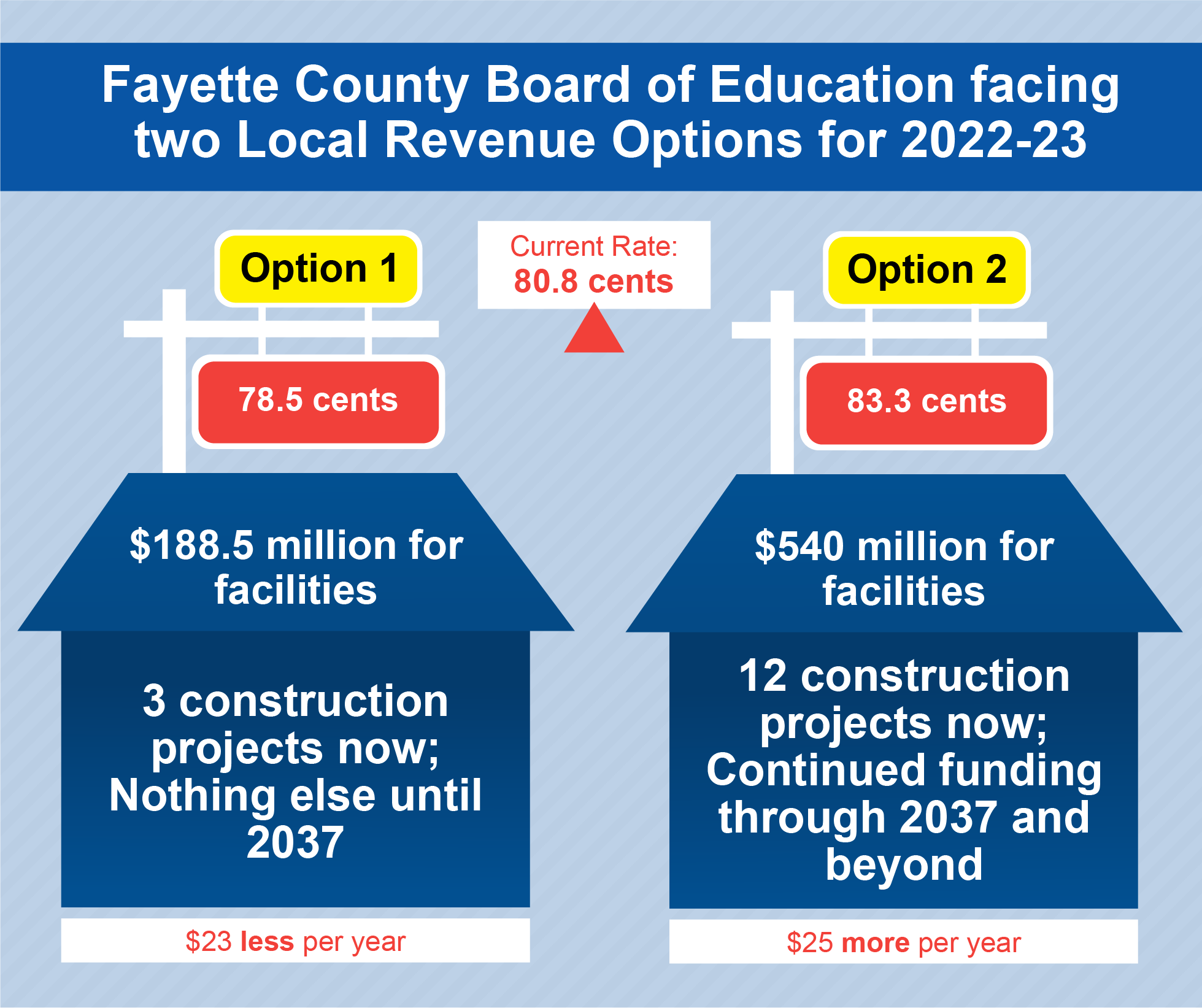

Fcps Board Discusses Change In Property Tax Rate

Fcps Board Discusses Change In Property Tax Rate

Delinquent Property Tax Department Of Revenue

Wilmore Property For Sale Located At 605 East Main Street Wilmore Ky 40390 Including Photos Maps And Prop Main Street Real Estate Listings Property For Sale

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

How To Find Tax Delinquent Properties In Your Area Rethority

/cloudfront-us-east-1.images.arcpublishing.com/gray/VVWVA7RXKFBU5GFJ3G4BKQQJWE.png)

Fcps Board Discusses Change In Property Tax Rate

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Tax Rates Rankings Kentucky State Taxes Tax Foundation

With Skyrocketing Home Prices Lexington Owners See Big Property Tax Increases